Asset Depreciation Software: Simplify Tracking

Managing your company’s fixed assets and calculating depreciation can be complex and time-consuming. Fortunately, with the right depreciation software with a license subscription, you can streamline this process, save valuable time, and ensure accurate financial reporting throughout the asset life cycle. This guide will explore the benefits and features of powerful and effective fixed asset depreciation software. Whether you are a small business owner or an accountant looking for efficient ways to handle asset depreciation and maintain asset records, this software can be your ultimate solution.

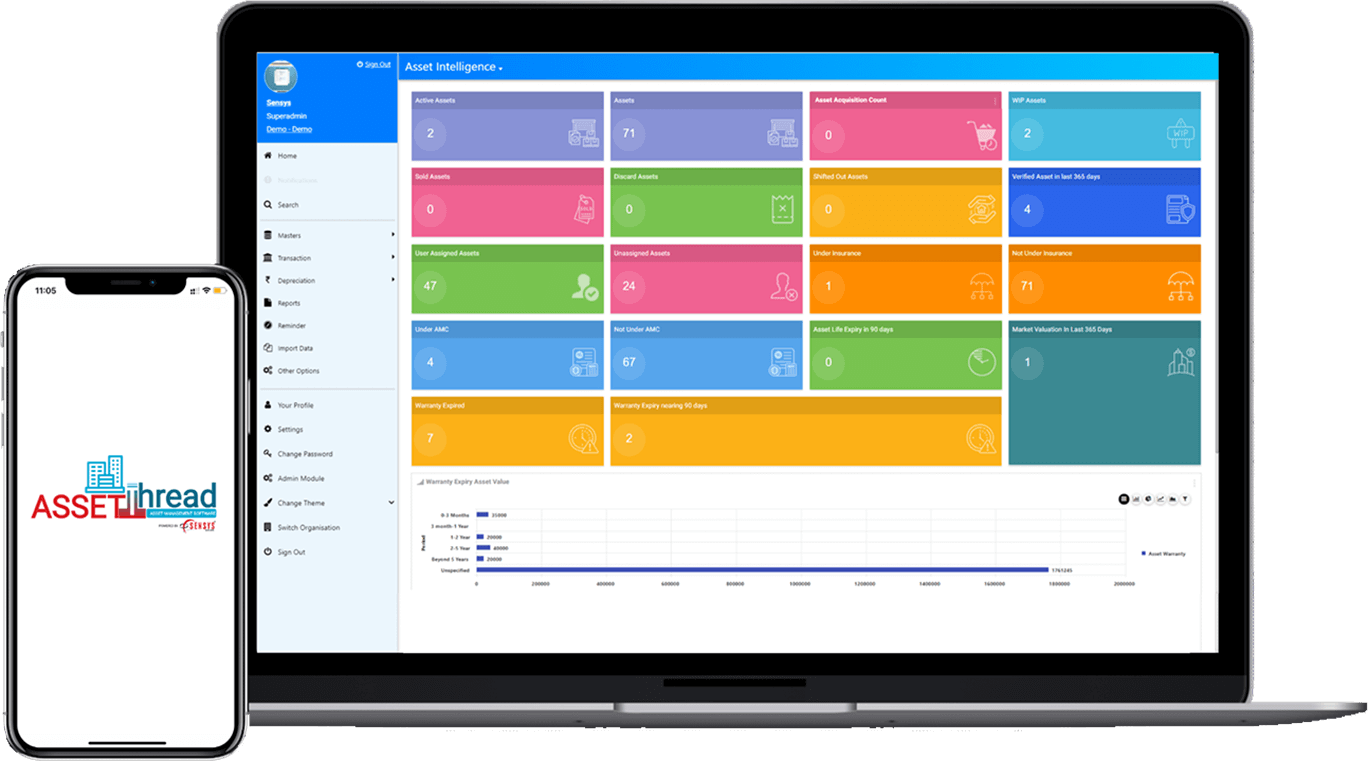

Features of Our Asset Depreciation Software:

Our fixed asset depreciation software offers a range of features designed to simplify your asset management:

- Multiple Depreciation Methods: Choose from straight-line, declining balance, double declining balance, and more to suit your business needs.

- Easy Asset Tracking: Keep a detailed record of all your assets, including purchase date, cost, and location, in one centralized location

- Depreciation Schedules: Generate comprehensive depreciation schedules for reporting purposes, making tax time a breeze.

- Customizable Reports: Tailor your financial reports to meet specific business requirements and present data in a format that makes sense to you and your stakeholders.

Benefits of using Asset Depreciation Software:

- Accuracy: Ensure precise and compliant asset depreciation calculations.

- Time Savings: Automate depreciation processes, freeing up valuable time.

- Cost Efficiency: Optimize asset-related expenses and reduce unnecessary costs.

- Financial Planning: Access real-time depreciation data for better budgeting.

- Enhanced Reporting: Generate comprehensive depreciation reports effortlessly.

- Customization: Tailor the software to match your unique asset portfolio.

Why Choose Our Asset Depreciation Software:

When it comes to choosing the right fixed asset software for depreciation calculation, you need a solution that is reliable, user-friendly, and backed by excellent customer support. Here’s why our depreciation calculation software stands out:

- User-Friendly Interface: Our intuitive interface ensures that even those without a background in accounting can easily navigate and utilize the software.

- Excellent Customer Support: Our dedicated support team is always ready to assist you with any questions or issues.

- Regular Updates: We stay up-to-date with tax laws and accounting standards, ensuring our software remains compliant and accurate.

- Data Security: Your asset data is very important. To ensure the safety of your information, our software uses strong security methods.

Contact Us:

Ready to take your asset management to the next level with our Fixed Asset Depreciation Software? Join us on this journey towards greater efficiency, accuracy, and financial control. When you partner with us, you’re not just getting software; you’re gaining a valuable ally in optimizing your asset management processes. Manage your asset history, asset updates, and personal property tax efficiently with Fixed Asset Pro.